Week 7 Newsletter and Picks

What a bounce-back week from the Orb! We were still in a good place on the season even after a down week 5 performance but week 6 lifted us back well above our target goal. We saw some crazy upsets and back door covers go down on Sunday but the real story to us has been happening well before kickoff recently. What is going on with these crazy high spreads this season? I feel like in a typical week we might see one 10-ish point spread that stands out as an outlier. Not only were there three double-digit spreads last week but the Orb, which has generally leaned towards underdogs, picked the favorite to cover all those points in every single one. The worst part is 2/3 of them did. What is happening to the game we love? The talent disparity is turning a superior product into college football with these insane numbers. But in a week in which Vegas cleaned house against the public with all formerly undefeated teams getting upset, the Orb had itself another big +unit performance. Here is how our models did in week 6:

Spreads:

Chiefs -10.5 (TNF) ✅

Ravens -4 ✅

Commanders +2.5 ✅

Dolphins -13.5 ✅

Patriots +2.5 ❌

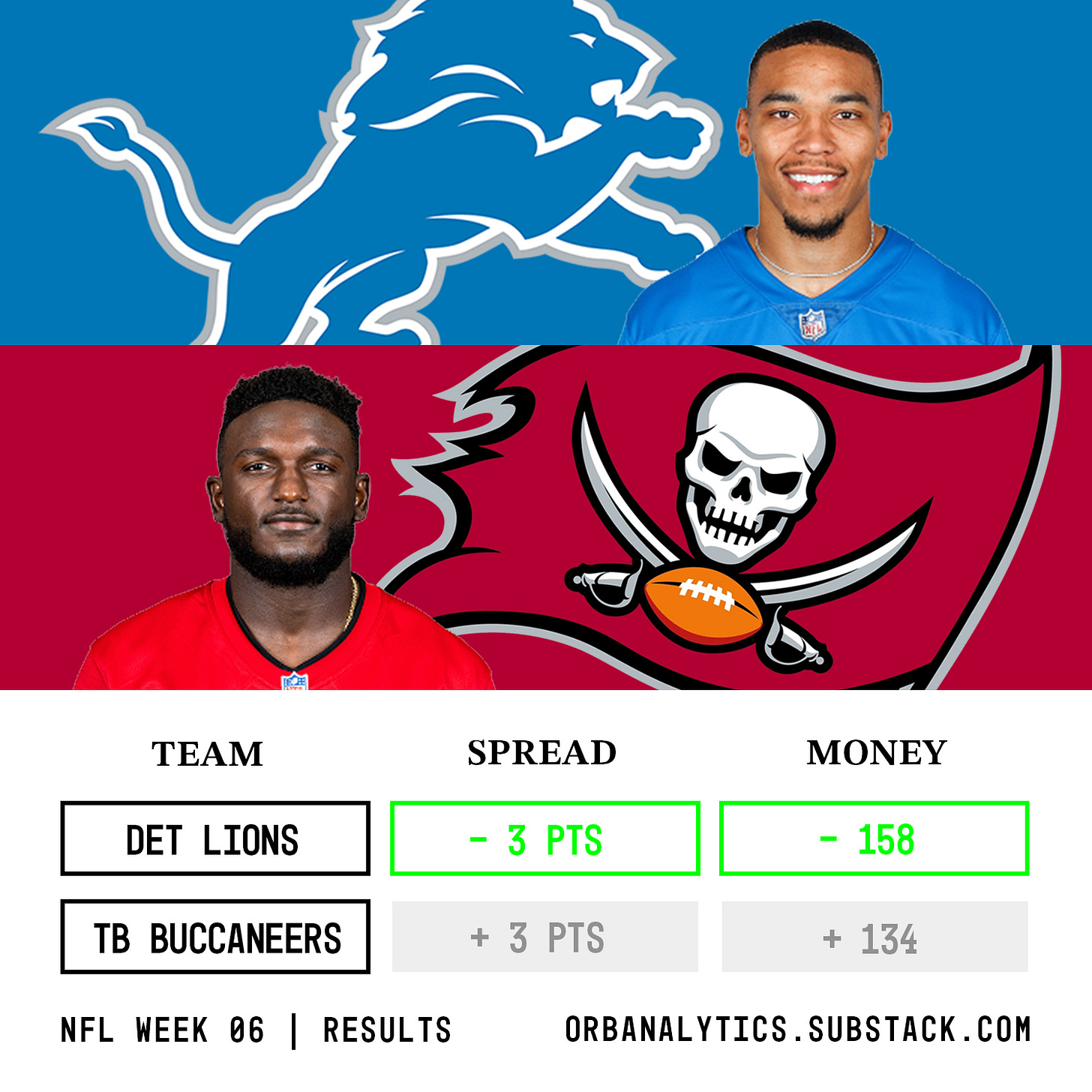

Lions -3 ✅

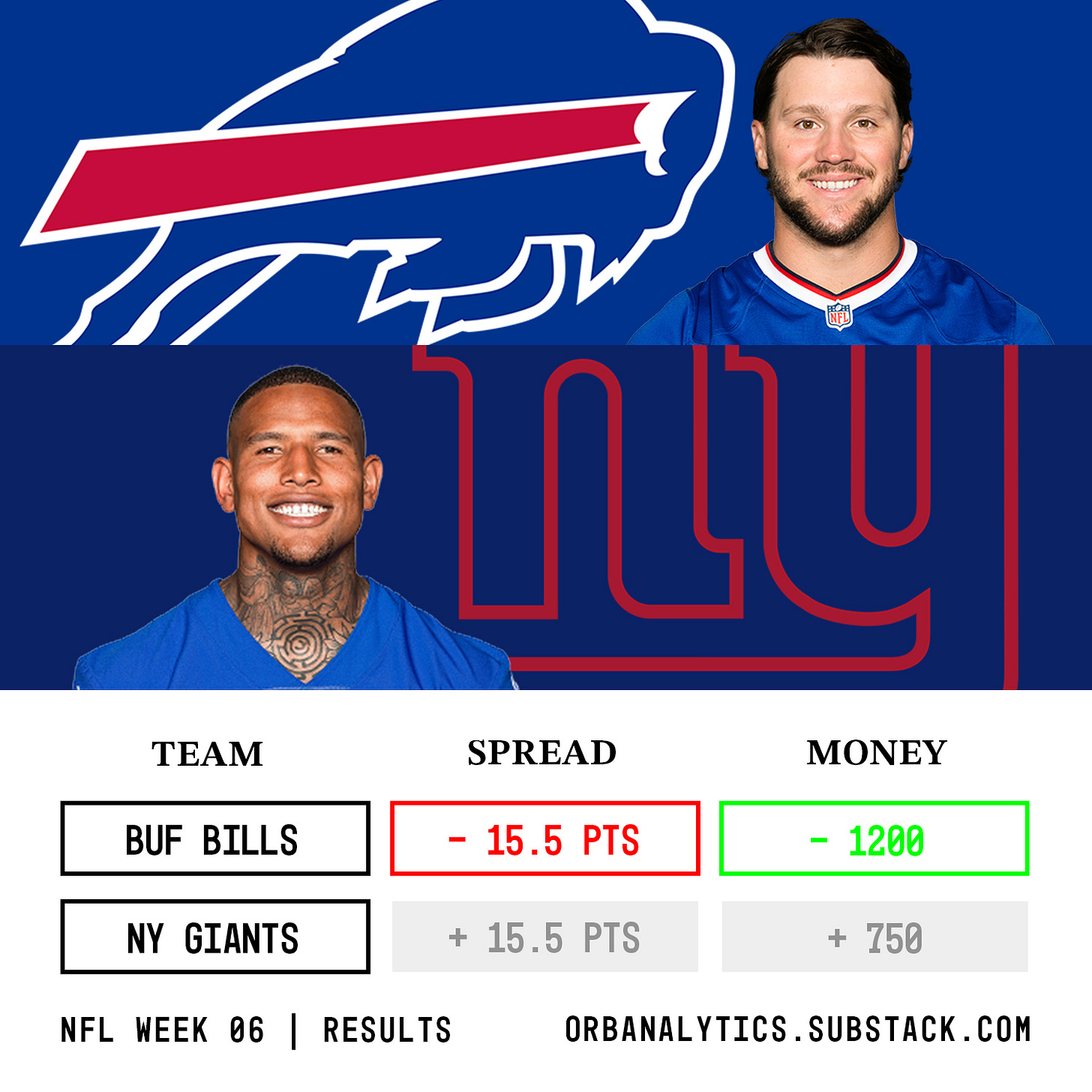

Bills -15.5 ❌

All spreads: 5-2, 71.4%, +2.545 units

Moneyline:

Chiefs (TNF) ✅

Ravens ✅

49ers ❌

Commanders ✅

Dolphins ✅

Vikings ✅

Jaguars ✅

Lions ✅

Rams ✅

Eagles ❌

Bills ✅

Cowboys (MNF) ✅

All moneyline: 10-2, 83.3%, +2.883 units

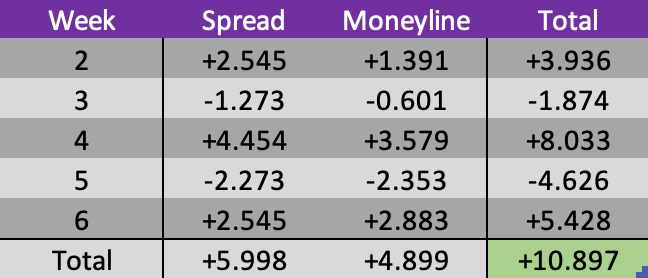

Overall a +5.428 unit week from the Orb! Since there is no official quarter mark of an 18-week regular season, we are going to break down the Orb’s performance from the first third of the season instead. Put simply, our models have performed quite well so far. Last season we had one multi-linear regression model and were underprepared for what Vegas had to throw at us. We spent time in the offseason developing multiple models and making the decision to move away from a linear approach in favor of a logistic one. Through testing, this eventually brought us to our Venn Diagram approach of only giving out picks in which all our models agree. Testing against the past is important for predictive modeling but offers no promise of how our algorithm would perform live in the season. Once week 2 rolled around and we had limited 2023 game data, all bets were off. Of course, things can change, and losing weeks are unavoidable but we are ecstatic to see the extent to which the hard work in the offseason has paid off between weeks 2-6. Here are the numbers:

Season-to-date pick totals:

Spreads: 22-14, 61.1%, +5.998 units

Moneyline: 38-17, 69.1%, +4.899 units

61.1% accuracy against a 36-pick sample size with each pick being 50-50 odds is no small task or coincidence. I didn’t want to do probability calculations in my free time so I explained the situation to chatGPT and it calculated the odds of hitting 22 or more spread picks out of 36 at 14.4%. Past performance is not a promise of future results, especially as our sample size increases and the laws of probability start to stack up against us, but we are proud of the Orb for what it has done so far and hope it continues along this path.

Unit performance by week:

This line graph is a great way to visualize the roller coaster trend we’ve seen so far. Essentially every even week has been a big +unit performance followed by a -unit week that halves the profits from the past week. This would project to roughly a -2.7 unit performance this week. We hope to buck the trend in week 7 but again, as long as the +’s are bigger than the -’s we are ok with that in the big picture. We would obviously rather have had our models hit at 61.1% each week with steady +unit performances but that is not how this game works. -Unit weeks suck but if they were avoidable Vegas wouldn’t exist.

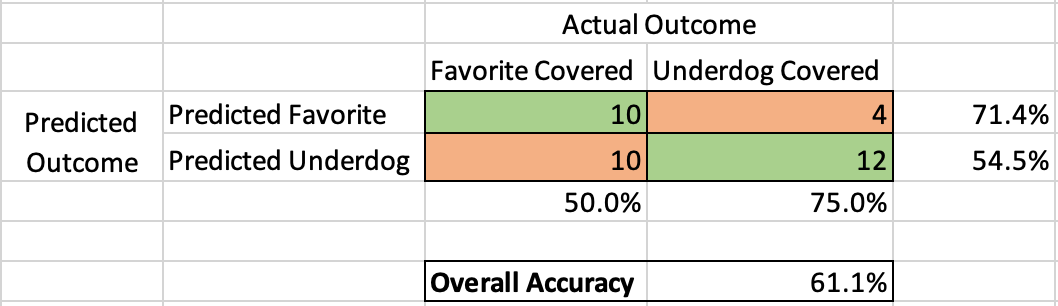

Finally, we wanted to look at our distribution of picks between favorites and underdogs against the spread to see if we could find anything interesting. Que the confusion matrix:

After the first few weeks, I was worried that we couldn’t beat the ‘underdogs only’ allegations as our models were loving a lot of teams getting points. The cool thing about predictive models is that they learn over time with new data. As we received 13-16 new data points each week, our models started adapting and picking more favorites. Interestingly, when our models have predicted the favorite to cover, they’ve been right 71.4% of the time. However, of the games that the Orb made picks in, when the favorite did cover we only predicted it 50% of the time. The inverse is true of underdogs where we’ve correctly predicted 12/16 of the games in which the underdog did cover but have only hit on 54.5% of all our underdog picks. The positive takeaway is that our favorite and underdog picks are both hitting above the 52.4% target line! Also a good example of how you can pick and choose how to present your data in a way that fits your narrative rather than objectively.

We want to start the second third of the season off on a good note and avoid repeating the halving cycle. Two +unit weeks in a row would only add to the numbers we just looked at above and give us even more confidence in our models. Here is what the Orb predicts will happen in week 7:

Spreads

Giants +3

Colts +3

Ravens -3

Broncos +1.5

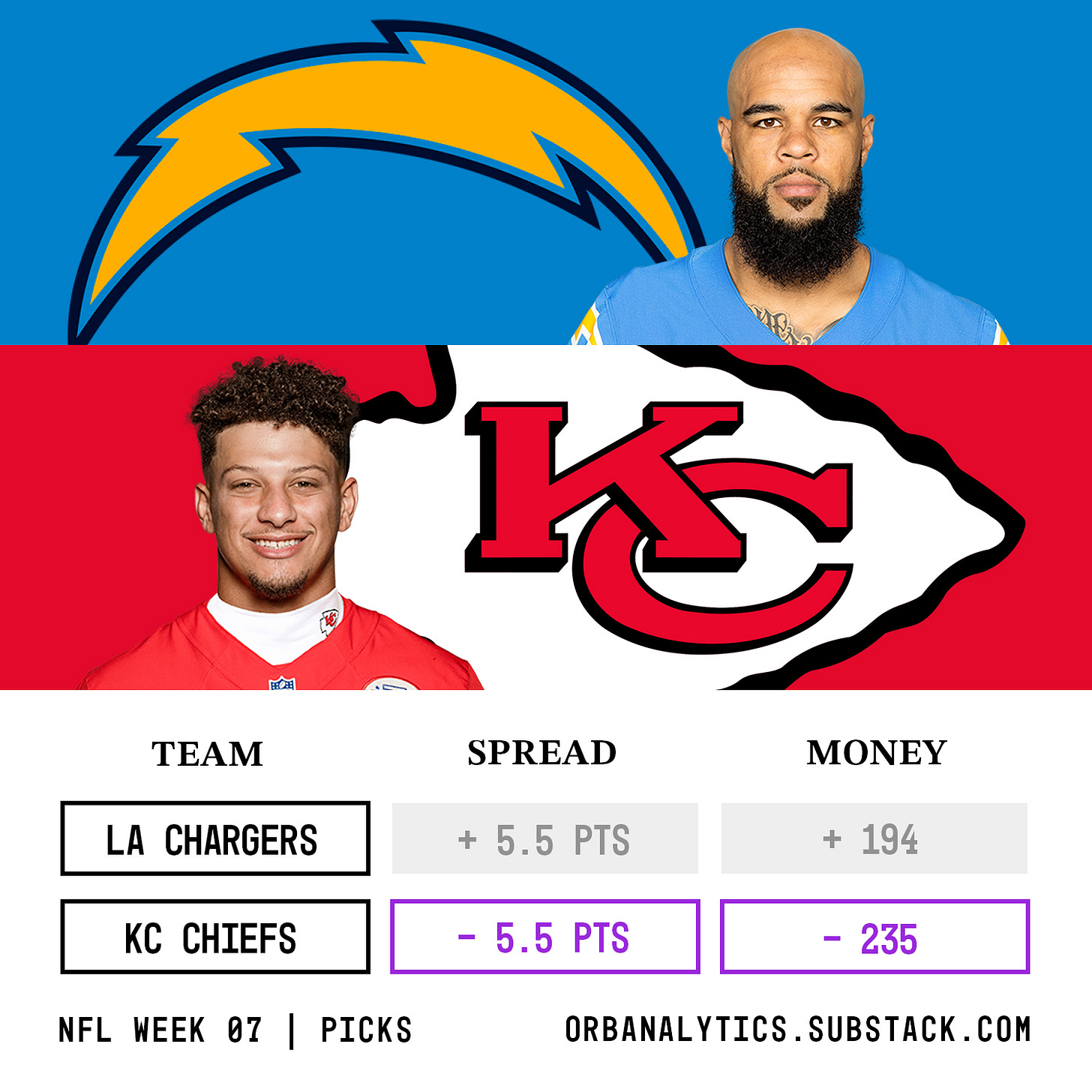

Chiefs -5.5

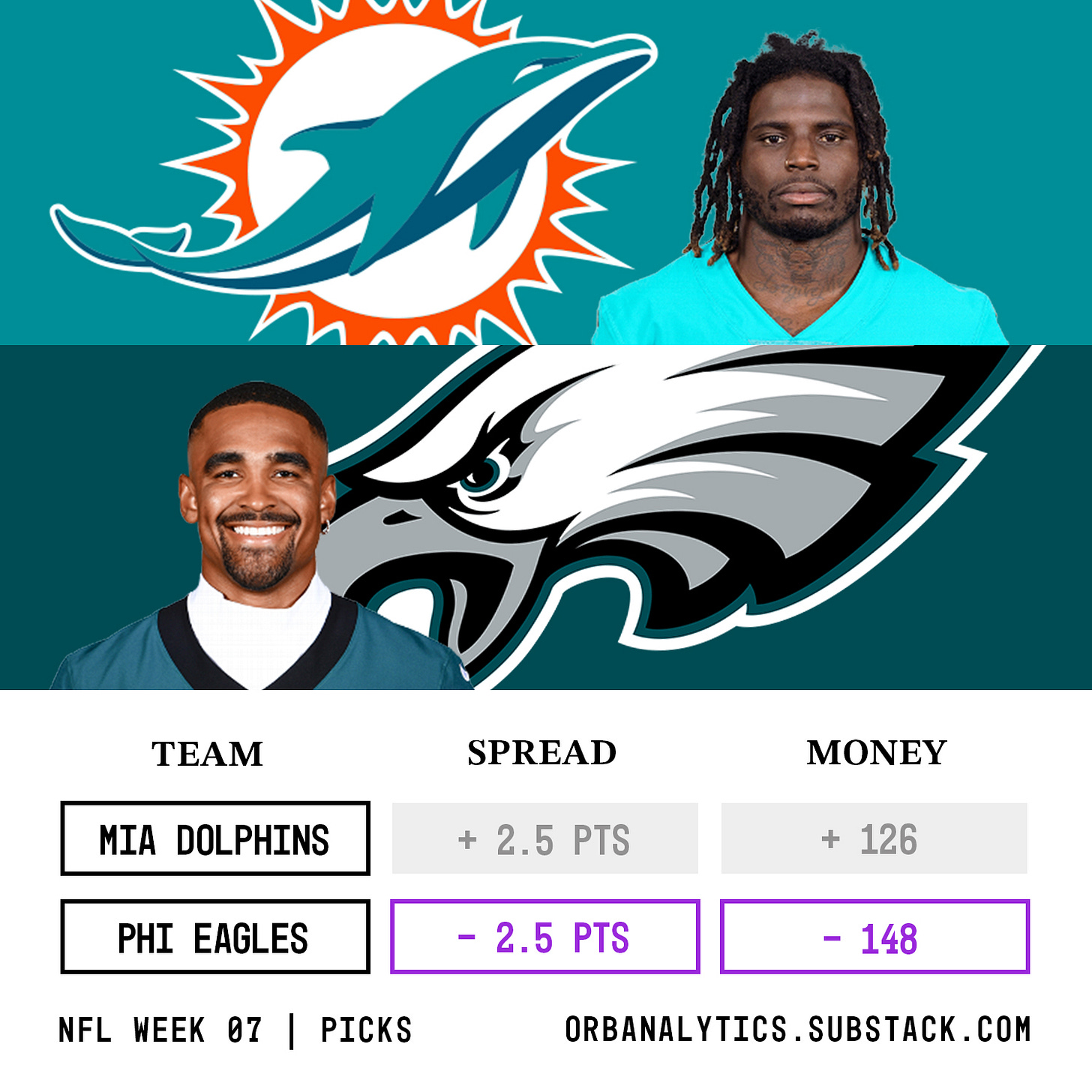

Eagles -2.5

Moneyline

Buccaneers

Rams

Seahawks

Broncos

Chiefs

Eagles

Are you guys tailing the Orb this week? Or are we confident enough that the halving cycle will continue and fading?

- Team Orb Analytics

.

.

.

.

.

.

DISCLAIMER:

The information provided on this website is for informational purposes only. It is not intended to be gambling or financial advice, and should not be relied upon as such. We are not responsible for any actions or decisions taken by readers based on the information provided on this website.

The picks and predictions provided on this website are based on our own research and analysis and are intended to be used for entertainment and informational purposes only. We do not guarantee the accuracy or completeness of the information provided, and we are not responsible for any losses or damages incurred as a result of using this information for gambling or other purposes.

By accessing and using this website, you acknowledge and agree to the terms of this disclaimer, and you assume all risks and liabilities associated with your use of the information provided on this website.