Things change quickly in the NFL and in modeling. The Orb went from its worst-ever performance slide to now trying to win 3 +unit weeks in a row. The model’s season record against the spread is sitting at 53.4%, exactly one percentage point above our season target goal so a winning vs. losing Sunday will be a big factor in determining if we have a successful season or not.

The sportsbooks and markets predict that we will not have too many exciting games as there are some ugly high lines in Week 16. Here is what the Orb model predicts will happen:

Spreads:

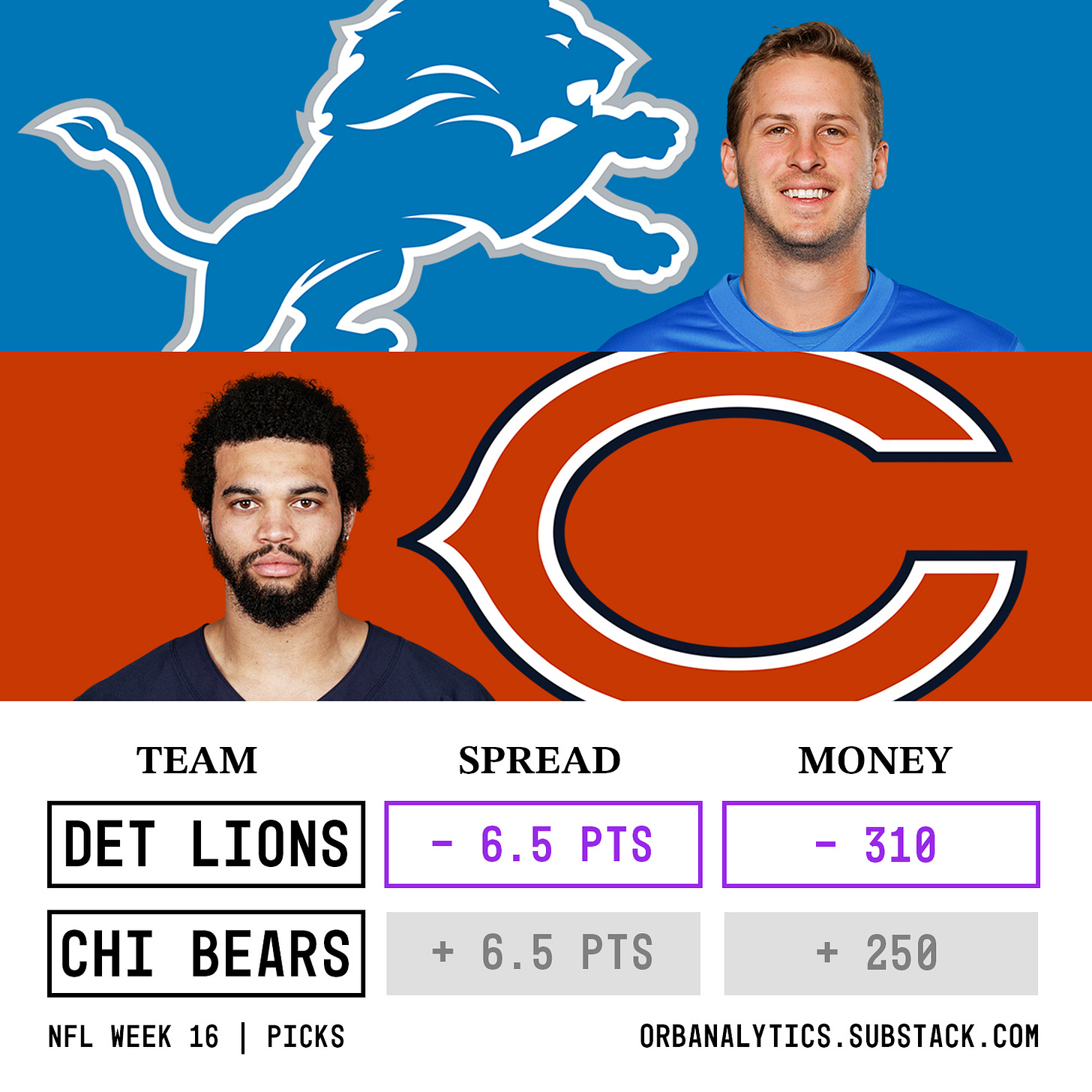

Lions -6.5

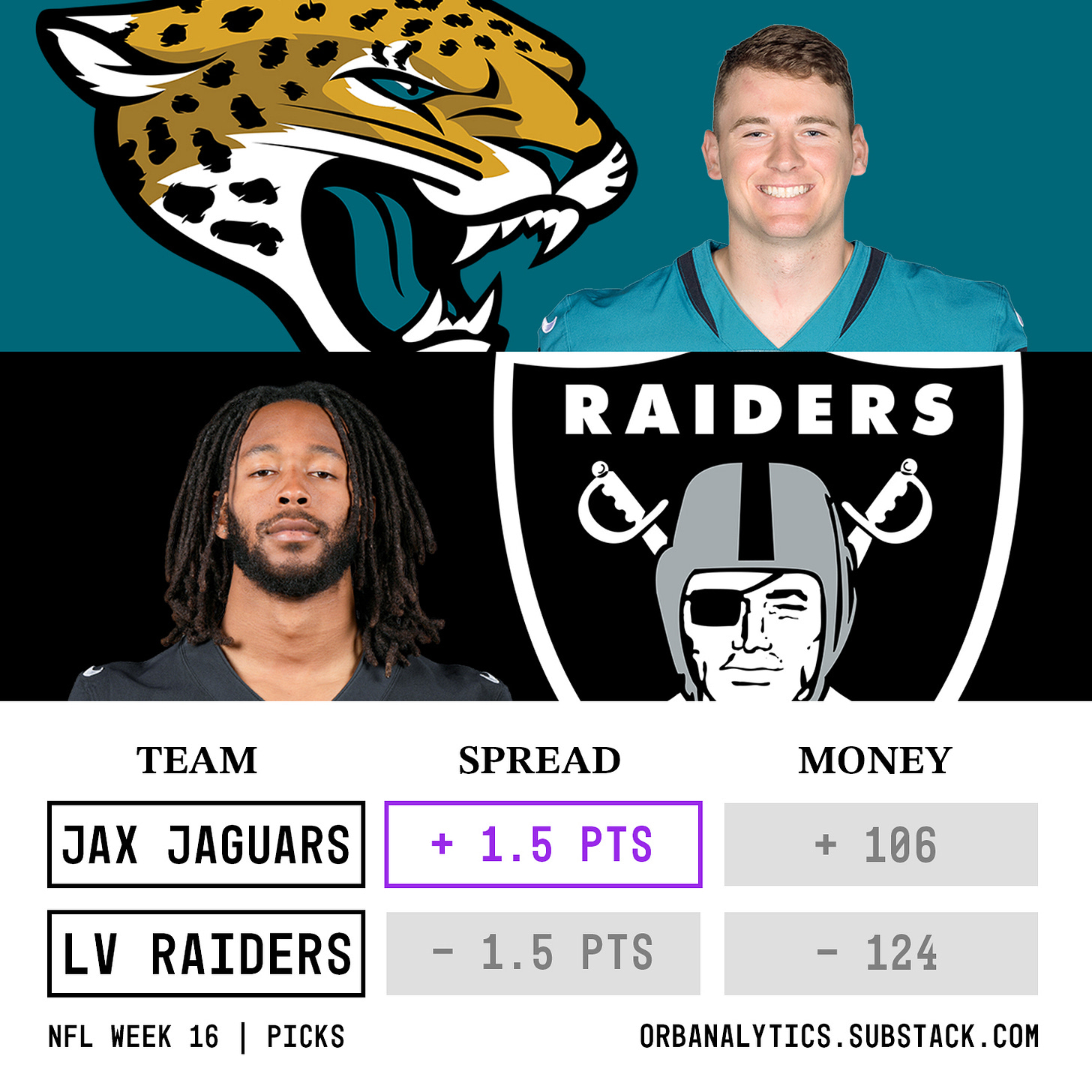

Jaguars +1.5

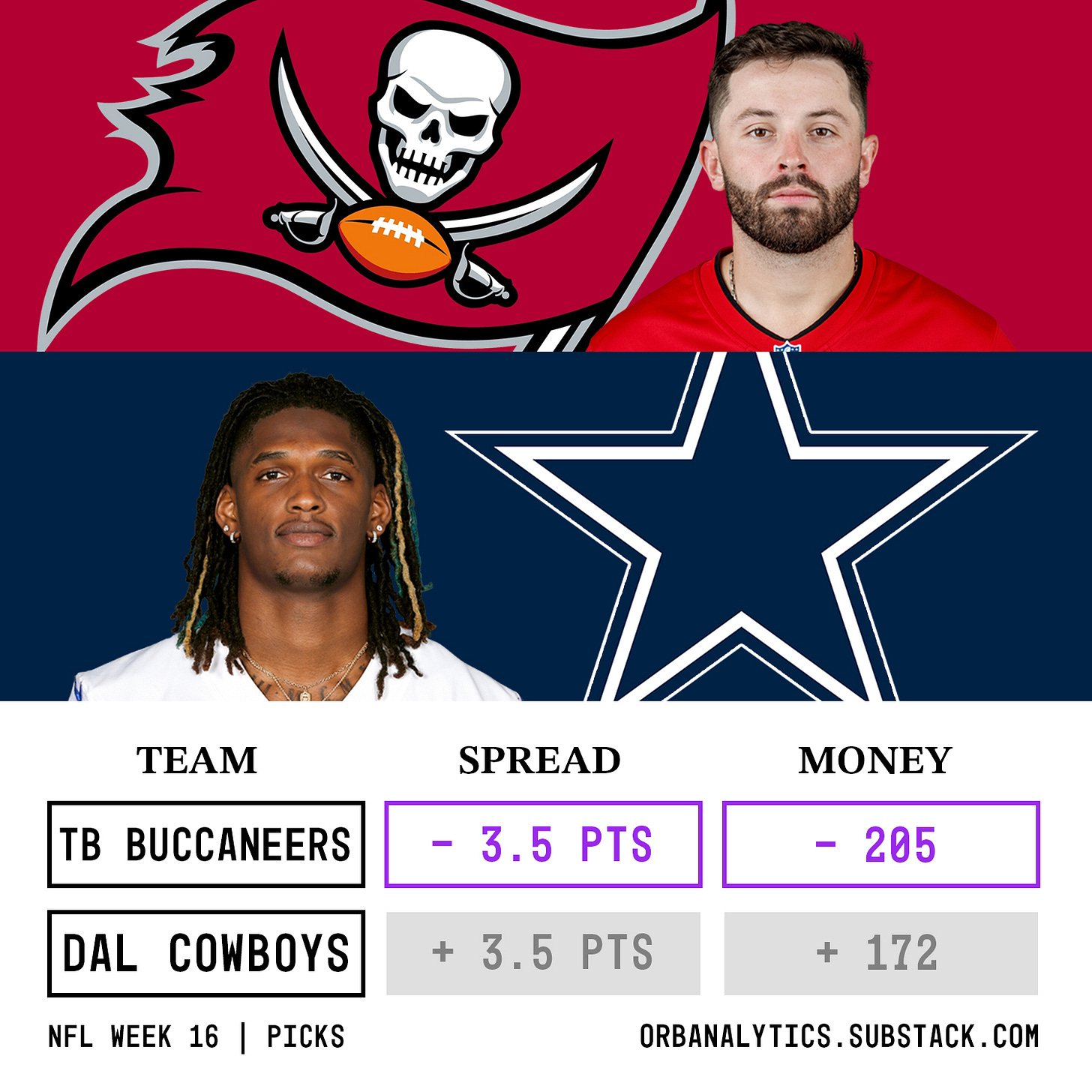

Buccaneers -3.5

Moneyline:

Chargers (TNF - Premium) ✅

Bengals

Cardinals

Eagles

Falcons

Colts

Lions

Vikings

Bills

Buccaneers

Week 16 Bonus Analysis: Has home field actually been an advantage this season for favorites?

Not including week 1, favorites have won 146/208 games straight up, for a win rate of 70.2% over the underdogs. Interestingly when the favorite has played at home, they have won 81/120 games, or 67.5% of the time. When a team is favored on the road, they have won 64/87 games for a win rate of 73.6%. So while the sample splits aren’t even, favorites have won at a 6.1% higher rate on the road than at home. On the flipside, underdogs are upsetting favorites at +money odds at a higher rate when they are on the road than when they are playing in front of their home crowds. Underdogs have won straight up 32.4% of the time when traveling to the favorite and have won just 26.4% at home.

We have seen a similar trend against the spread. Overall not including week 1, favorites have covered the spread in 111/208 games so far for a cover rate of 53.4%. When playing at home, favorites have covered 62/120 games or 51.7% of the time. On the road, they have covered 48/88 games for a dominant (and profitable) 54.5% cover rate.

The data suggest that home field has not been an advantage for favorites this season as they are winning and covering at lower rates in their own stadiums than they are on the road. So why is this? My hypothesis is that the perceived advantage from playing at home that the oddsmakers and markets give a team is actually hurting them. Teams generally get a few extra points on the spread when at home vs on the road. When two relatively evenly matched teams play, the line tends to favor whichever team is home as people add in this idea that it is actually an advantage. When we take a look at games in which the home team has been favored by a small number, in this case looking at lines that are 3-points or less, the results are interesting. The slightly favored home team has only won 55.8% of the time (down from the 67.5% win rate overall at home) but has covered in 53.5% of these games which is an increase over the overall 51.7% cover rate of home favorites. So when the difference in who is favored is heavily impacted by which team is home, there has been a lot of value on the underdogs in moneyline picks, but slight value on the favorites to cover. It is an interesting phenomenon as it is rare to win outright and not cover as a favorite when the line is a field goal or less.

Let’s hope these trends continue on Sunday as the two favorites the Orb is backing to cover are on the road, and the underdog Jaguars are potentially getting points only because the game is in Las Vegas.

- Team Orb Analytics

.

.

.

.

.

.

DISCLAIMER:

The information provided on this website is for informational purposes only. It is not intended to be gambling or financial advice, and should not be relied upon as such. We are not responsible for any actions or decisions taken by readers based on the information provided on this website.

The picks and predictions provided on this website are based on our own research and analysis, and are intended to be used for entertainment and informational purposes only. We do not guarantee the accuracy or completeness of the information provided, and we are not responsible for any losses or damages incurred as a result of using this information for gambling or other purposes.

By accessing and using this website, you acknowledge and agree to the terms of this disclaimer, and you assume all risks and liabilities associated with your use of the information provided on this website.